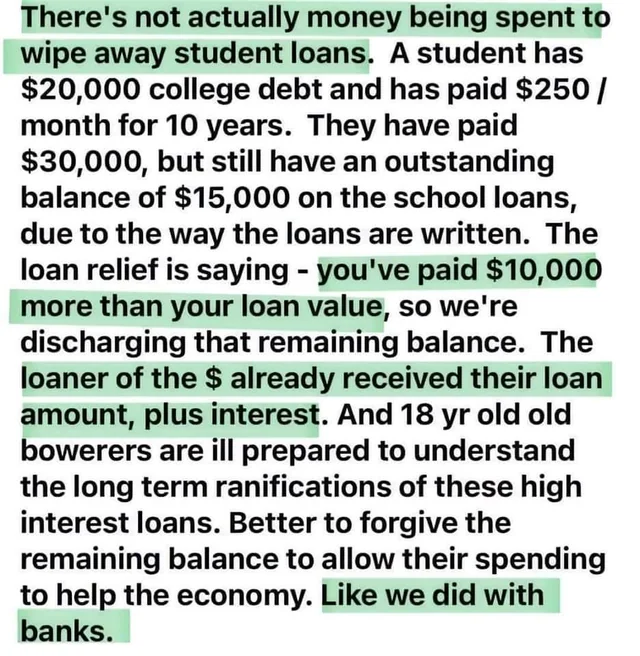

It was this, posted in all serious earnestness:

I was sorely tempted to snark at this on FB. Unfortunately, it was posted by a wonderful lady I went to high school with, and had a major (unrequited) crush on back then, over a half-century ago.

In fact, I still kind of have a crush on her. I don't want to hurt her feelings.

So I'll retreat to snarking here. I'm pretty sure she doesn't read Pun Salad. I'll use my Fisking template: The dumbness is reproduced in its entirety on the left with a lovely #EEFFFF background color; my remarks are on the right.

|

There's not actually money being spent to wipe away student loans. |

True, in a sense. That money was "spent" when it went into the coffers of higher education institutions. Now, the only question is: who's gonna pay it back? |

|

A student has $20,000 college debt and has paid $250/ month for 10 years. They have paid $30,000, but still have an outstanding balance of $15,000 on the school loans, due to the way the loans are written. |

Um, yes. That's the way loans work. But the numbers caused me to seek out this loan calculator. If you are paying $250/month on an initial balance of $20K, and only manage to work your balance down to $15K after 10 years, that seems to imply an interest rate of 13.83% or so. That's, um, reality-challenged. Actual student loan interest rates (current and historical) aren't, and never have been, that high. (Data here.) |

|

The loan relief is saying - you've paid $10,000 more than your loan value, so we're discharging that remaining balance. |

That may be what they're saying—I have no idea. But what they are doing (or attempting to do) is a transfer of loan debt from the borrower to US taxpayers, present and future. This shouldn't be hard to understand. |

|

The loaner of the $ already received their loan amount, plus interest. |

The "loaner" is the buyer of US government debt: t-bonds, t-notes, and t-bills. They would not (and should not be expected to) get less than the promised return on their investment. They expect to be paid back in full, in real money. In fact, if the government did try to stiff its creditors, that would be a default. There would be headlines. And the whole government financial scheme would teeter. And… Well, it wouldn't be pretty. |

|

And 18 yr old old bowerers are ill prepared to understand the long term ranifications of these high interest loans. |

Gee, I always kind of suspected it was a mistake to let these kids vote. If "bowerers" can't understand "ranifications" of their freely-chosen financial obligations, what are the chances they'll make wise choices in the voting booth? Worse than a coin-flip, I'd bet. |

|

Better to forgive the remaining balance to allow their spending to help the economy. |

… which ignores the money taxpayers will be shelling out to cover the "discharged" debts of student borrowers. That's money those taxpayers will not be "spending to help the economy." Recommended reading: That Which is Seen, and That Which is Not Seen, by Frédéric Bastiat. |

|

Like we did with banks. |

Yeah, that was a bad idea too. But at least (at the time) people were making the argument that it was necessary to prevent the US financial system from collapsing. That is not the case with student loan bailouts. It's just naked vote-buying, and nobody's bothering to pretend differently. And at least the bank bailout was (more or less) OKd by Congress. That's not the case with student loan bailouts either. The shift (both proposed and enacted) of debt burden from borrowers to taxpayers is carried out via executive decree. I'm currently reading C. Bradley Thompson's America's Revolutionary Mind, an examination of the political theory behind the Declaration of Independence. The Americans of that time would not have hesitated to call this "taxation without representation". And an instance of tyranny. Sadly, we live in more docile times. |

![[The Blogger and His Dog]](/ps/images/me_with_barney.jpg)