It has been a couple of months since we mentioned Leavitt's Country Bakery and its spat with Conway NH mural nazis. Emma Camp brings us up to speed: Lawsuit Over New Hampshire Donut Mural Heads to Trial. In case you missed it:

Can a local government prevent a business owner from painting a mural on their own property? That question is now before a New Hampshire federal court following a dispute over one bakery's painting of baked goods above its store in Conway, New Hampshire.

Leavitt's Country Bakery is an acclaimed bakery in small-town New Hampshire—even getting the No. 1 spot on a local news outlet's list of the "best doughnuts in New Hampshire" in 2022. That year, owner Sean Young collaborated with a local high school's art class to paint a mural for the store. The class painted a colorful mural of baked goods—muffins, donuts, and cookies—arranged to resemble a mountain range, with brightly colored sunbeams in the background. The mural was painted on panels and installed above the storefront.

While community members seemed to appreciate the mural, the local government did not. According to a lawsuit filed on behalf of the store by the Institute for Justice (I.J.), a public interest law firm, about a week after the mural was unveiled, the town's Code Enforcement Officer Jeremy Gibbs told Young that his mural broke local zoning rules. Further, Gibbs admitted that the action against the mural wasn't motivated by an outside complaint—instead, he decided to step in after seeing a news story about the colorful mural.

The trial seems to have started last Friday, although no results have been reported as near as I can tell.

And now, stuff about tariffs. But also the housing crisis. But mostly tariffs:

-

Also, don't bring me down, Groos. Dominic Pino advises: Don't Let Other Countries Set U.S. Tax Rates. Why would we think that's a good idea? Oh, right:

“Reciprocal tariffs” are framed to sound like a simple matter of fairness. But there’s nothing fair about letting other countries make U.S. tax policy, and that’s what the Trump administration’s proposal amounts to.

The basic principle of national sovereignty on taxation was a major flashpoint during the Biden administration, when Secretary of the Treasury Janet Yellen was trotting around the world trying to create a global corporate-tax cartel. As NR’s editors said of Yellen’s attempt at creating a global minimum corporate tax, “Taxation and sovereignty are inextricably intertwined. Different countries have different taxing and spending priorities.”

“Reciprocal tariffs” would similarly outsource U.S. tax policy to other countries. The administration’s as-yet-unclear proposal would reportedly include considering non-tariff factors such as other taxes, subsidies, regulations, and exchange rates along with tariffs in setting the “reciprocal” rate for the U.S.

The key is the framing. If you concentrate on the frame, the framers are hoping you won't notice the lousy picture it holds.

-

Also unframed. The WSJ editorialists also consider the proposal, deeming it Trump’s Tariff Stress Test.

Is President Trump trying to put markets through a stress test? It feels like it. Stocks rallied Thursday after Mr. Trump announced a temporary reprieve from the global reciprocal tariffs he threatened earlier this week. Try to catch your breath before his next blunderbuss tariff shot.

Mr. Trump earlier in the week teased plans to impose tariffs on other countries that don’t match their duties on American exports with U.S. levies on the same goods. Most countries impose higher tariffs on average than the U.S., so this would mean that duties on most imports would rise, and more so for countries like India with higher trade barriers.

It almost seems as if Trump is playing chicken with trade. Or just trying to extricate himself, in a face-saving way, from a policy that nearly every reputable economist says is misguided?

-

For example, this guy at Dartmouth. Econ prof Douglas A. Irwin pulls no punches: ‘Reciprocal’ Tariffs Make No Sense.

At an Oval Office press conference Thursday, President Trump confirmed that he’s going ahead with his reciprocal tariff plan. The U.S., he said, will impose the same tariffs on other countries as they impose on the U.S.: “No more, no less.” That sounds fair—we treat them the way they treat us—but it’s actually a terrible idea.

It amounts to outsourcing U.S. tariff policy to other countries. They would dictate what our tariffs would be. If other countries put high tariffs on American goods, then we would impose high tariffs on their goods. So much for American sovereignty. So much for deciding what’s in our own national interest. The British economist Joan Robinson once said that a country shouldn’t throw rocks into its own harbors just because other countries have rocky coasts. The same principle applies here: The U.S. shouldn’t have stupid tariff policies just because other countries have stupid tariff policies.

But as Forrest Gump was fond of saying: Stupid is as stupid does.

That probably applies here, although don't ask for details.

-

Willing to extend the benefit of the doubt. David Friedman is (at least) willing to look for a pony among all the horseshit: Retaliatory Tariffs.

I have finally encountered a kind of tariff that I am not sure I am against. The idea is to impose the same tariff on another country’s exports that they impose on your exports. A tariff makes the country that imposes it worse off, a fact that neither Trump or most of the media appear to understand — Vance may — but it makes the country it is imposed against worse off as well. Imposing a tariff can be in the interest of the politicians who impose it for public choice reasons, as a way of buying support from a concentrated and well organized interest group such as the auto industry at the expense of a dispersed interest group such as their customers. That is one of the two reasons tariffs exist, the other being that the false theory of trade economics is simpler and easier to understand than the true theory.

But another country’s tariff barriers against your exports make both your country and its politicians worse off. So if imposing tariffs on their imports results in tariffs being imposed on their exports, it might be in the interest of the politicians as well as the country they rule to lower, even abolish, their tariffs — and free trade, zero tariffs, is my first best tariff policy.

I'm doubtful that can square with Trump's long professed love of tariffs qua tariffs. But I want to be open to optimism.

-

Dave figures it out. Where "it" is: The Housing Crisis.

If you've been keeping up with the news — which I do NOT advise — you're probably aware that we're having a Housing Crisis, caused by the fact that there aren't enough houses. I don't know why there aren't enough houses, although it wouldn't surprise me, as a longtime subscriber to The New York Times, if the culprit turned out to be Global Climate Change, which has been linked to basically every bad thing that happens, including autotuning and reality television.

But whatever the cause, there aren't enough houses for all the people who want them. The result is that housing prices are insanely high, because of what economists call the Law of Supply and Demand, as illustrated by this graph provided by the distinguished London School of Economics:

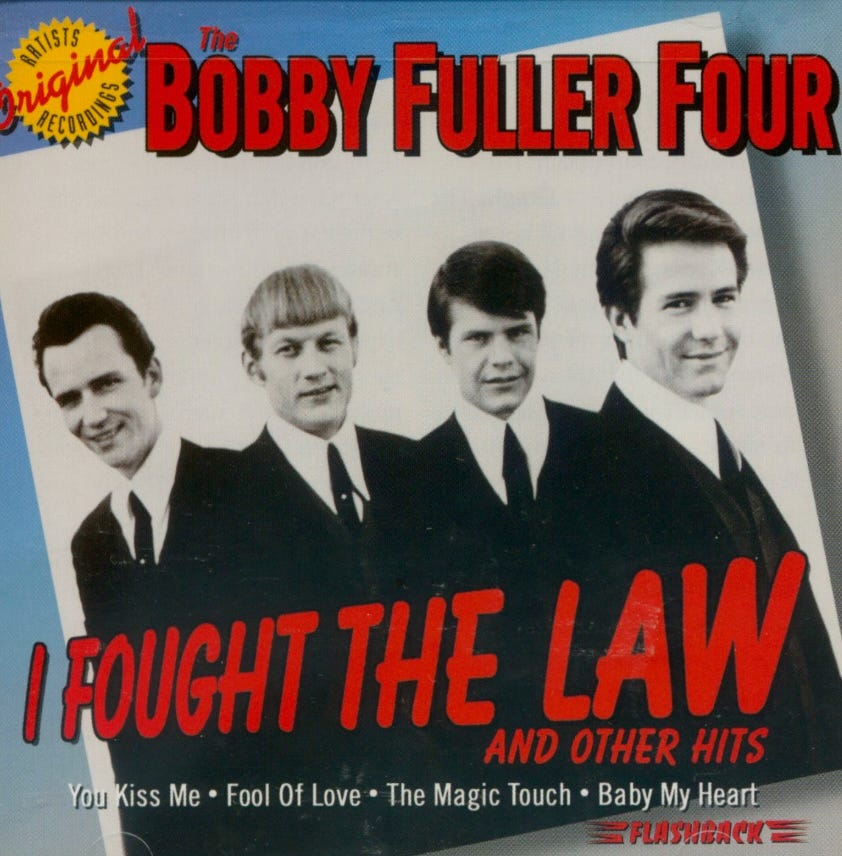

The law of Supply and Demand, which was discovered in 1966 by the Bobby Fuller Four Distinguished Economists, states: "I fought the law of supply and demand, and the law of supply and demand won."

What does this technical "lingo" mean in simple layperson's terms? It means that today's young people cannot afford starter homes. This is a tragedy, because having a starter home has been a cherished American tradition dating back to the frontier days, when young pioneer couples looking for "a place of their own" could simply set off into the wilderness, find a plot of land, whack down some trees and build a rustic log cabin to call home. Granted, the vast majority of these pioneers died within weeks from lethal wilderness hazards such as raccoon bites. But during those weeks they were living the American dream.

I've subscribed to Dave's substack, because of his own housing crisis, described later in his article. He could use the cash.

| Recently on the book blog: |

![[The Blogger and His Dog]](/ps/images/me_with_barney.jpg)