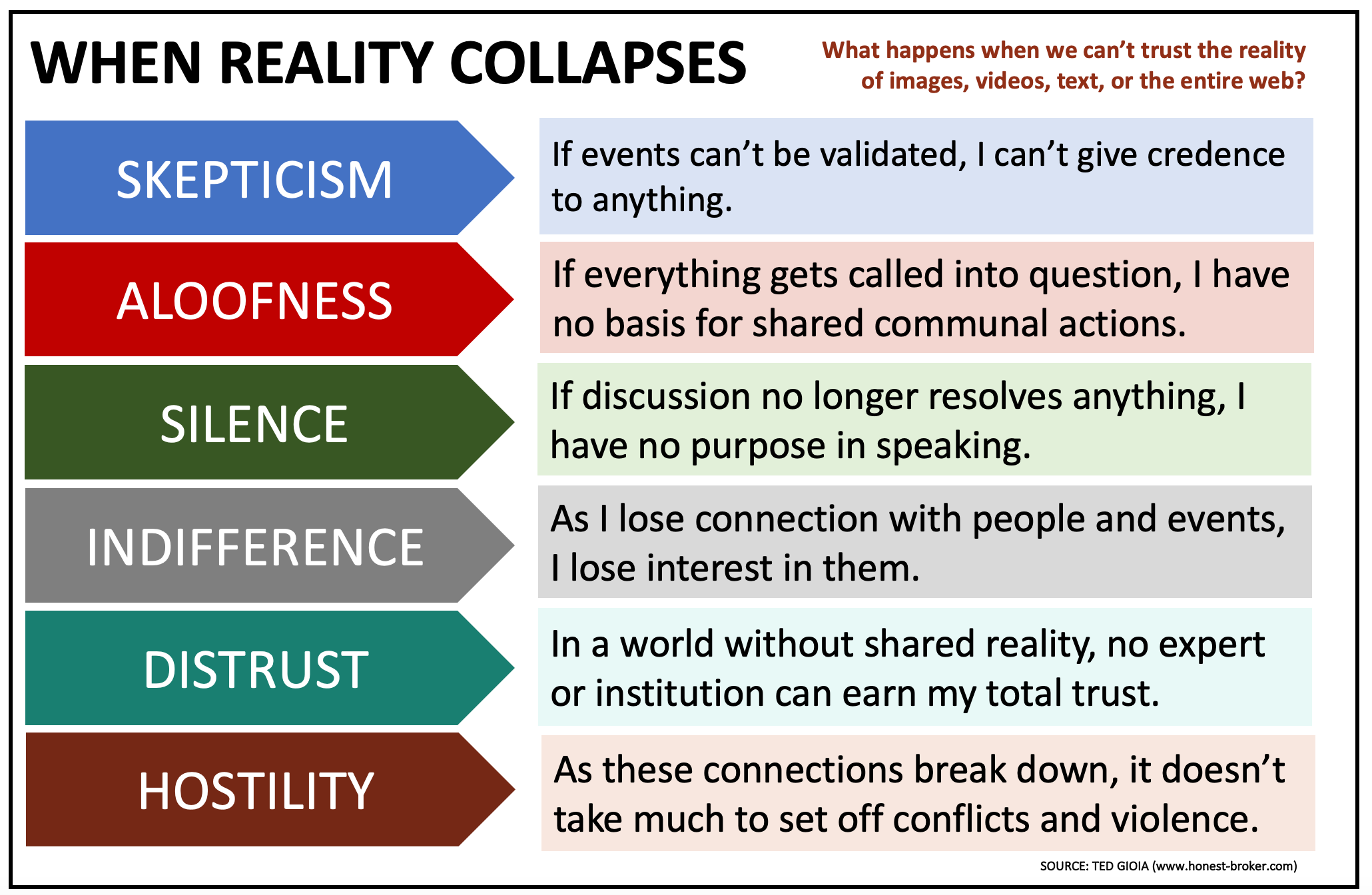

Our Eye Candy du Jour certainly seems pessimistic, doesn't it? It's from Ted Gioia's "Honest Broker" substack, and his headline isn't Pollyannish either: Our Shared Reality Will Self-Destruct in the Next 12 Months.

It is now possible to alter reality and every kind of historical record—and perhaps irrevocably. The technology for creating fake audio, video, and text has improved enormously in just the last few months. We will soon reach—or may have already reached—a tipping point where it’s impossible to tell the difference between truth and deception.

Can I tell the difference between a fake AI video and a real video? A few months ago, I would have said yes. But now I’m not so sure.

Can I tell the difference between fake AI music and human music? I still think I can discern a difference in complex genres, but this is a lot harder than it was just a few months ago.

Can I tell the difference between a fake AI book and a real book by a human author? I’m fairly confident I can do this for a book on a subject I know well, but if I’m operating outside my core expertise, I might fail.

At the current rate of technological advance, all reliable ways of validating truth will soon be gone. My best guess is that we have another 12 months to enjoy some degree of confidence in our shared sense of reality.

But what happens when it’s gone?

Ted seems kind of down on skepticism, but an appropriate level of it really sounds like a good idea to me. As long as you don't slip into nihilism, solipsism, or one of those other dysfunctional isms.

Also of note:

-

It's helpful to find trustworthy sources. One of those is Jessica Reidl, and she was doubly helpful yesterday, pointing out a source you should never trust about anything, anytime:

Today alone, the White House has claimed:

— Jessica Riedl 🧀 🇺🇦 (@JessicaBRiedl) September 1, 2025

-$8 trillion in new tariff revenue.

-$4 trillion in net deficit reduction.

-$5 trillion in new business investment.

-Hundreds of thousands of jobs from these investments.

-Record low gas prices.

Each claim is completely, 100%, made-up. https://t.co/NlwUbz5bIpAnother source not in thrall to any party is Tyler Cowen, who cuts right to the credibility issue: Markets Say Relax. Trump Critics Say Panic. Who’s Right? Yes, the S&P500 index is doing quite well. Some reasons for concern:

First, the One Big Beautiful Bill Act, passed earlier this year, slashed corporate taxes. Before Trump’s first term, the corporate tax rate was 35 percent; in his first term Trump cut it to 21 percent, and this year he and the Republican Congress extended aspects of that first-term tax bill. Factors such as 100 percent bonus depreciation and expanded interest deductions give many companies the ability to lower their tax bill further, though not in a way that can be expressed readily by any single number.

With these lower tax burdens, companies should be worth much more. At the same time, the American taxpayer now owes more than $37 trillion in debt. So someone has to pay higher taxes over time, to satisfy those obligations. That someone probably is you, so you might want to take that into account in your overall assessment. But you should feel good about the companies, and somewhat less good about yourself and your children, given the tax hikes in the offing, sooner or later. You are paying for some of those higher stock market values.

Another relevant fact is that Trump is engaging in some amount of corporate statism. For instance, he announced that the federal government is taking a 10 percent share in Intel. The Intel share price rose on that news, as the market took this as a signal that the federal government is committed to the success of the company. Overall, it could be that the Trump policies help large, easily identifiable, incumbent companies with which Trump can make highly visible deals. That same favoritism may be less positive for the long-run economy and for companies that have not yet been created.

Here's Tyler's bottom line:

I return here to the same logic: If you think the market is being naive and foolish, why aren’t you placing your bets in the opposite direction? At the very least you could be wealthier under the forthcoming fascism you predict, and you might even be able to donate your winnings to antifascist causes.

The wiser thing to do, however, is to pay some heed to these market prices and let go of some of your more exaggerated notions of how the world is likely to evolve.

If I had to sum this all up in a single sentence, it would be this: Things are neither as good as President Trump and his supporters claim, nor are they as dire as his critics assert.

And that is our economic wisdom for the day. Prices change all the time, so that judgment should be subject to ongoing revision. But don’t just consult your feelings; look at what the actual markets are telling us.

Thanks to Fidelity, my investment strategy is to close my eyes, cross my fingers, and hope I won't be kicking myself next month for not liquidating everything, and buying gold to bury in the back yard.

-

Katherine Mangu-Ward says "Relax". She's another person I trust (except for SF book reviews). And she advises: Don't Fear 'Frankenfood.' We're Already Living in the Lab-Grown Future.

Things didn't go well the first time Rebecca Torbruegge took a turn at the go-kart track. She ended up with a burn on her leg that refused to heal and eventually—skip the next bit if you're squeamish—"started bubbling." Doctors in Sydney quickly determined she'd need a graft. But instead of following the usual procedure of scraping a patch from the 22-year-old's backside, slapping it over the wound, and hoping for the best, researchers wondered if she'd like to try something new: custom-printed skin, laid down layer by layer by a machine, built from her own cells.

Asked about her decision to become the first human recipient of bedside 3D bioprinting in May, Torbruegge offered this delightfully Australian understatement to a local news station: "I thought about it for a bit, and then thought, 'Yeah, why not?'"

Torbruegge might be garbage at go-karting, but she's right about how we should approach our lab-grown future. A new era of printed, cultured, grown, and engineered stuff is coming fast around the bend, and we should greet it with a shrug.

KMW (and Rebecca Torbruegge) are a needed chaser of optimism after (say) Ted Gioia's shot of 80-proof doomsaying.

-

Trust Deirdre McCloskey on matters economic. She provides a short column from Brazil on Marginalism.

“Marginalism” is the essence of good economics.

But until the 1870s, economists, even very great ones like the Blessed Adam Smith, and certainly his follower Karl Marx, didn’t understand it. Marx, and his followers such as Mariana Mazzucato, who advises Lula on innovation, never did get it.

Marginalism says that in making a decision today about the future we should look forward. Pretty obvious, eh? Think about deciding today how many engineers to work on artificial intelligence in your innovative factory in São Paulo. Obviously, the correct way to decide is to imagine what would be the contribution of the next engineer you hire, in addition to what you already do and know. It’s called her “marginal product.” Then compare it with her wage. If the marginal product is greater than her wage, hire her. Then do the same for the next one, and the next. Stop when another would be stupid. That way you hire in the correct, efficient amount—by looking forward “marginally,” step by step.

It’s common sense, right? It’s like your decision in consuming beer. Does the next beer give you more “marginal utility” than its cost you in money? If so, buy. Keep doing it until you’re full. . . or are so drunk you can’t find your wallet.

Speaking of beer, I saw that my local Hannaford has switched over from Sam Adams' Summer Ale to Oktoberfest. Sigh.

![[The Blogger]](/ps/images/barred.jpg)